jefferson parish property tax assessment

Remember to have your propertys tax id number or. The AcreValue Jefferson Parish LA plat map sourced from the Jefferson Parish LA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres.

What Jp Residents Need To Know To Pay Property Tax

Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website.

. If the parcel does not have a HEX then the. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Whether you are presently living here only contemplating taking up residence in Jefferson Parish or planning on investing in its property find out how municipal property taxes work.

Welcome to the Jefferson Davis Parish Assessor Web Site. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 in Gretna and is open to the public from 830 am. The median property tax on a 17510000 house is 75293 in Jefferson Parish.

This property includes all real estate all business movable property personal property and all oil gas property and equipment. Administration Mon-Fri 800 am-400 pm Phone. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website.

The telephone is 504-363-5637. The median property tax in jefferson parish louisiana is 755 per year for a home worth the median value of 175100. The preliminary roll is subject to change.

If your homesteadmortgage company usually pays your property. 4730520 when sold to a Louisiana Commercial Fisherman who qualifies as such under applicable state law and who complies with certification procedures developed by the Jefferson Parish Sheriff as tax collector for Jefferson. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

The median property tax on a 17510000 house is 31518 in Louisiana. Commercial Fisherman The sale of materials and supplies which qualify for an exclusion and exemption under LSA-RS. The Jefferson Parish Assessors Office determines the taxable assessment of property.

If a Homestead Exemption HEX is in place you would then subtract 7500 75000 HEX x 10 from the assessed value to get the taxable amount. If you have documents to send you can fax them to the. Jefferson Parish Assessors Office - Property Search.

These taxes may be remitted via mail hand-delivery or filed and paid online via our website. The total number of parcels both commercial and residential is 185245. The median property tax on a 17510000 house is 183855 in the United States.

Property taxes for 2020 become due upon receipt of the tax notice. A county-wide sales tax rate of 475 is applicable to localities in Jefferson Parish in addition to the 445 Louisiana sales tax. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

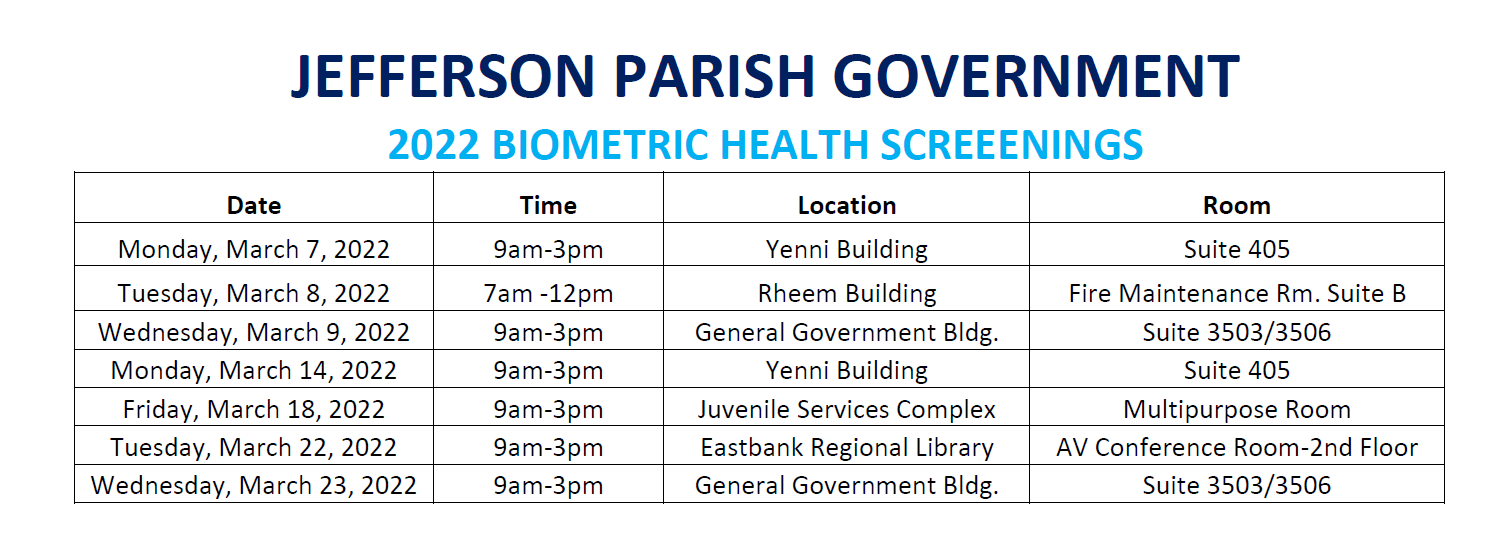

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Mail the form to. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill.

They are maintained by various government offices in Jefferson Parish Louisiana State and at the Federal level. The jefferson parish assessors office has announced it is opening its tax rolls from september 29 2021 through october 13 2021. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

Jefferson Parish Sheriffs Office. Property Maintenance Zoning Quality of Life. The preliminary roll is subject to change.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. When are property taxes due in louisiana. They are a valuable tool for the real estate industry offering both.

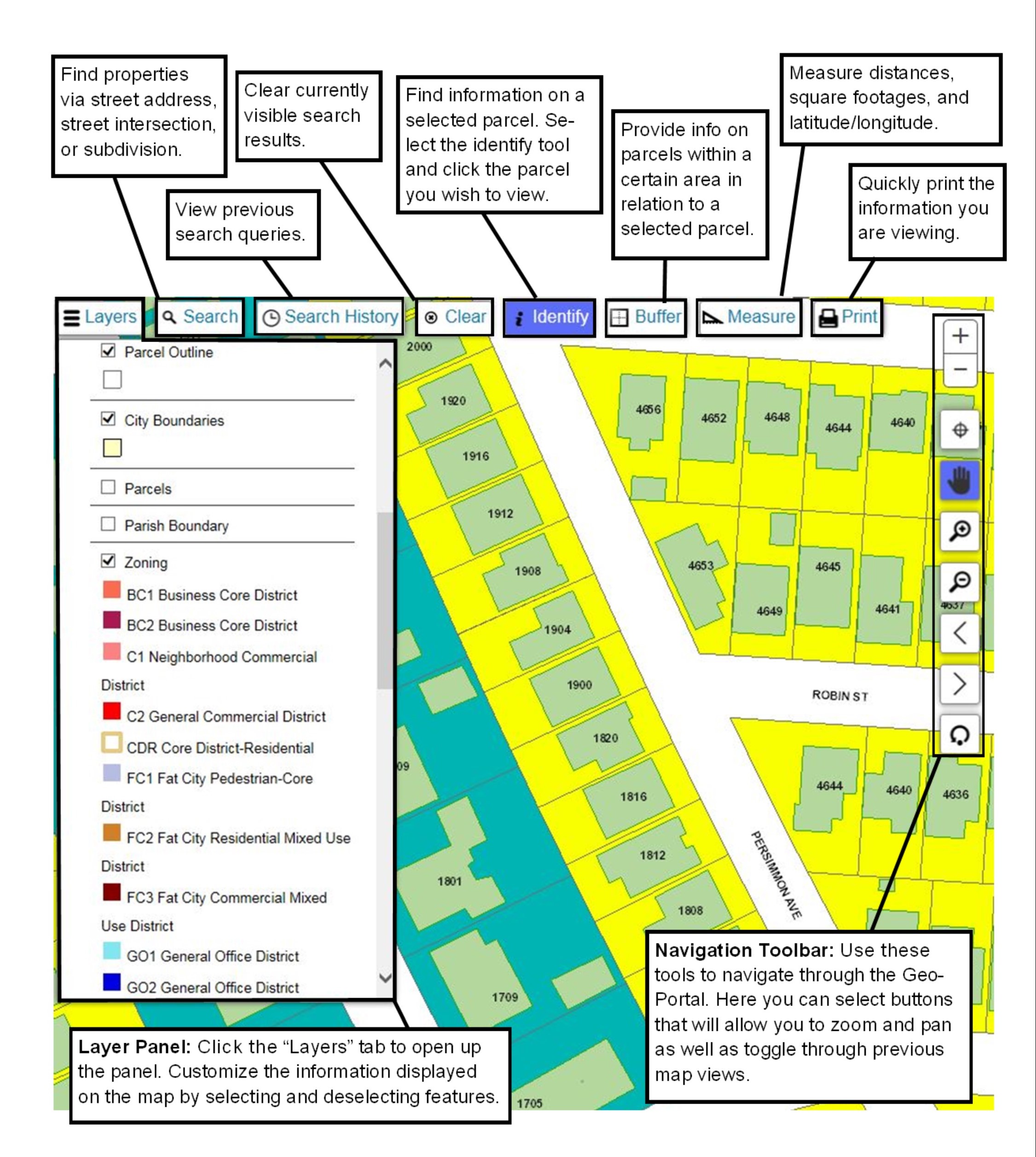

This website will assist you in locating property ownerships assessed values legal descriptions estimated tax amounts and other helpful information that. Jefferson Parish Assessors Office - Property Search. There are 2 Food Stamp Offices in Jefferson Parish Louisiana serving a population of 437038 people in.

Lopinto III as the Ex-Officio Tax Collector of Jefferson Parish will begin printing the 2020 property tax notices to Jefferson Parish residents and businesses by Monday December 7 2020. With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. The Jefferson County PVA is responsible for applying a fair and equitable assessment to over 260000 residential properties in Jefferson County as of January 1st of each year.

This gives you the assessment on the parcel. Commercial Property The Jefferson County PVA is responsible for applying a fair and equitable assessment to over 21000 commercial properties in Jefferson County as of. 200 Derbigny St Suite 1100.

1233 Westbank Expressway Harvey LA 70058. Free Jefferson Parish Assessor Office Property Records Search. The median property tax in jefferson parish louisiana is 755 per year for a home worth the median value of 175100.

Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes. Welcome to the Jefferson Parish Assessors office.

To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Find Jefferson Parish residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations ownership past.

To 430 pm Monday through Friday. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate. The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection law enforcement education recreation and other functions of parish government.

See reviews photos directions phone numbers and more for Property Taxes locations in Jefferson Parish LA. 2022 Assessor Property Records Search Jefferson County CO. You can call the Jefferson Parish Tax Assessors Office for assistance at 504-362-4100.

Please call 504-362-4100 and ask for the personal property department if you have any questions.

Property Tax Overview Jefferson Parish Sheriff La Official Website

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

Property Tax Overview Jefferson Parish Sheriff La Official Website

Kean Miller Wins Major Property Tax Case At Louisiana Supreme Court Louisiana Law Blog

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

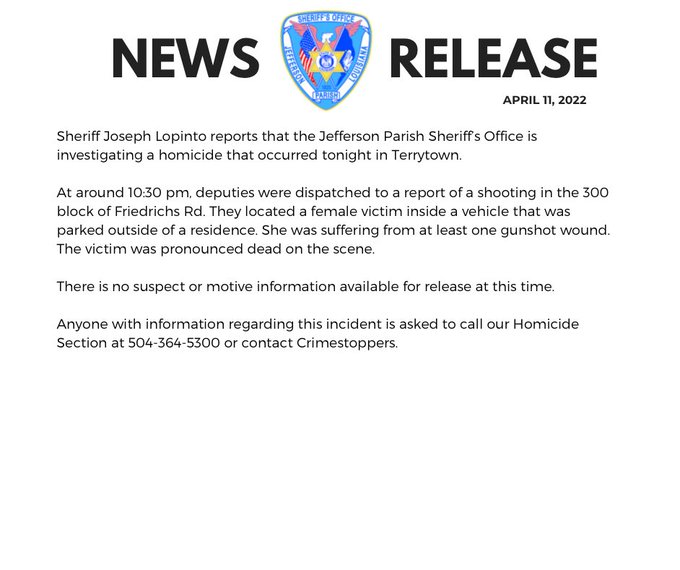

Jp Sheriff S Office Jeffparishso Twitter

Property Tax Overview Jefferson Parish Sheriff La Official Website

Luxury Apartment Building Near Wrigley Field For Sale Multifamily Apartment Building Luxury Apartment Building Multifamily Property Management

St Tammany Parish Sheriff 007 Sheriff Office Sheriff Police Cars

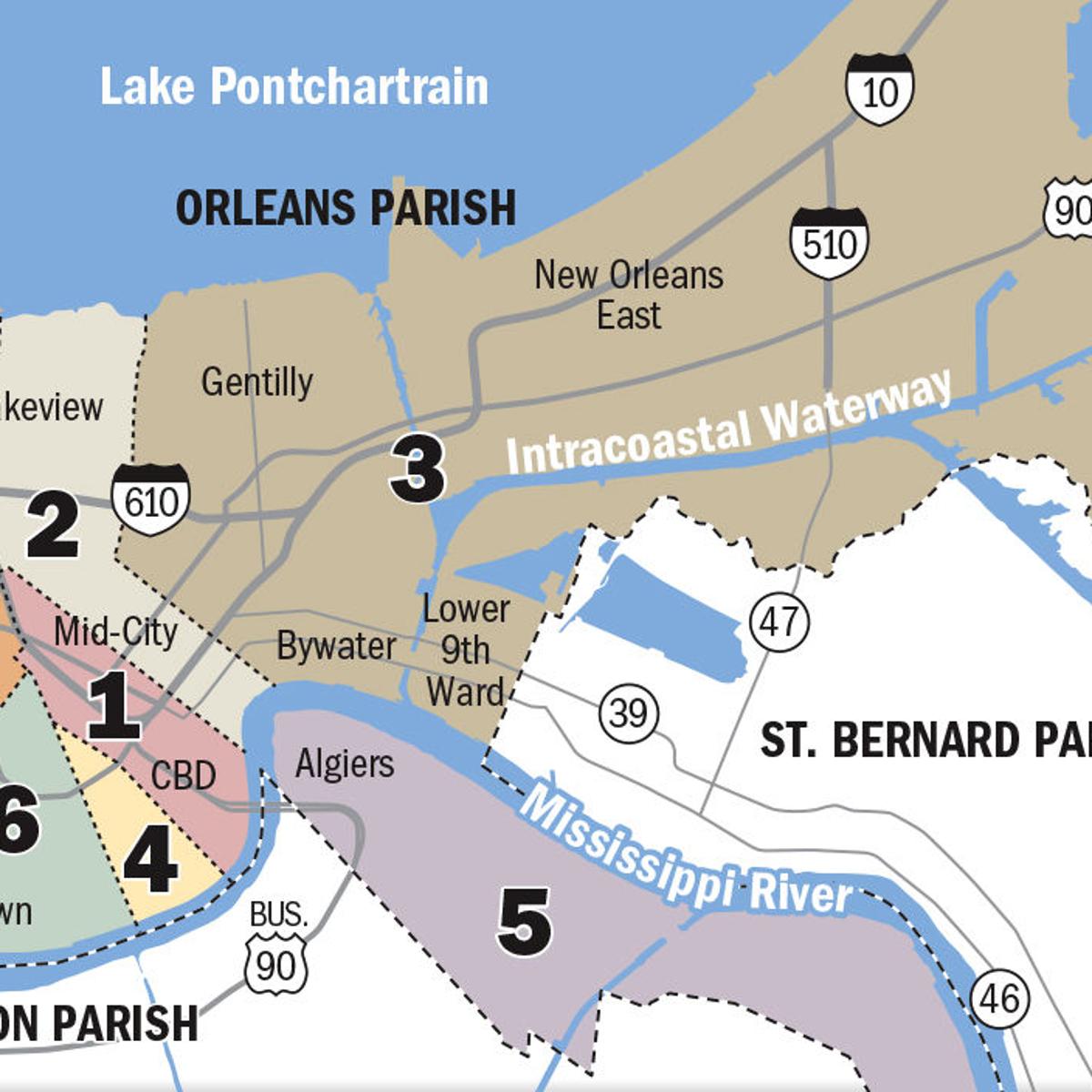

Orleans Parish Property Transfers June 22 26 2020 Business News Nola Com